fha loan ct guide for first-time and repeat buyers

What this program offers

The FHA mortgage can make Connecticut homeownership more attainable with down payments as low as 3.5%, flexible credit standards, and the option to use gift funds. It also allows higher debt-to-income ratios than many conventional loans, which helps buyers in many markets.

Who it fits and how to use it

An fha loan ct can suit buyers seeking a primary residence, including approved condos and 2–4 unit properties, letting you live in one unit and offset payments with rent. Closing costs can be covered by seller concessions up to 6%, and renovation needs may be financed with an FHA 203(k). Be mindful of upfront and annual mortgage insurance, and check county loan limits in areas like Fairfield or Hartford.

- Start with a thorough preapproval: income, assets, employment, and credit.

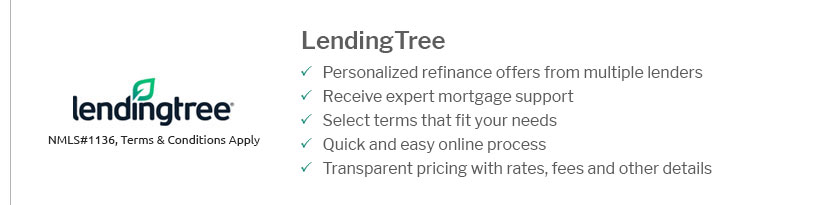

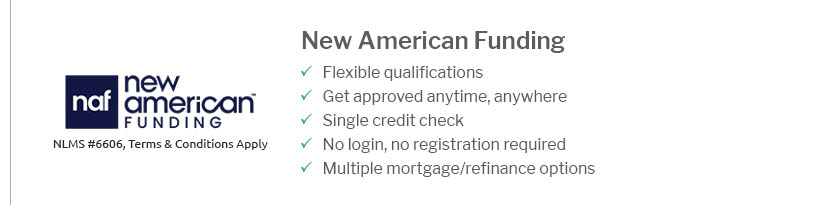

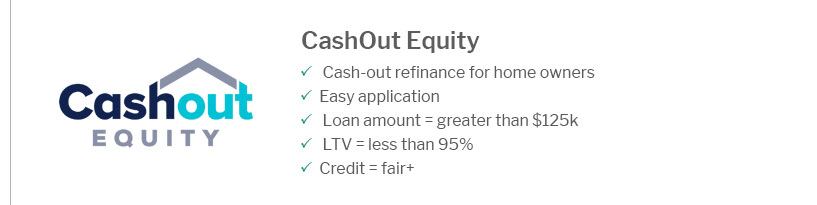

- Compare lenders on rate, MIP, and total cash to close.

- Ask about down payment assistance and grants layered with FHA.

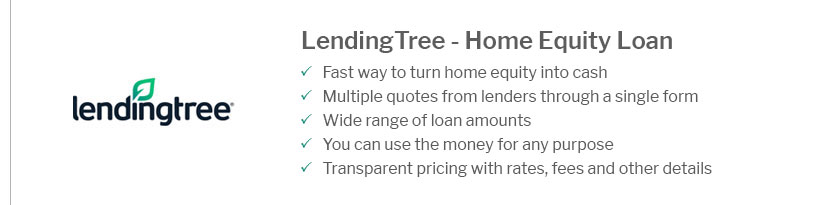

- Consider a streamlined refinance if rates drop after closing.

- Budget for taxes and insurance to keep ratios healthy.

With clear expectations and a solid plan, an FHA path can balance affordability, flexibility, and long-term stability.